st louis county sales tax 2020

Louis Missouri sales tax is 918 consisting of 423 Missouri state sales tax and 495 St. Interactive Tax Map Unlimited Use.

Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St.

. ALL PROPERTIES HAVE BEEN SOLD. 112020 - 122020 - PDF. 2020 rates included for use while preparing your income tax deduction.

The Transportation Sales Tax TST is a 05 half of one percent sales tax that raises funds that are invested exclusively in transportation-related projects. Questions answered every 9 seconds. Louis County is land that has forfeited to and is now owned by the State of Minnesota for the non-payment of taxes.

You can print a 9679 sales. The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax. Louis County Courthouse 100 North 5th Avenue West Duluth MN 55802.

Louis Sales Tax is collected by the merchant on all qualifying sales made within St. Tax-forfeited land managed and offered for sale by St. The St Louis County sales tax rate is.

182021 30001 PM. 2020 sales tax rates. Ad Download tables for tax rate by state or look up sales tax rates by individual address.

This rate includes any state county city and local sales taxes. Florida Estate Tax Apportionment Statute. Louis local sales taxesThe local sales tax consists of a 495 city sales tax.

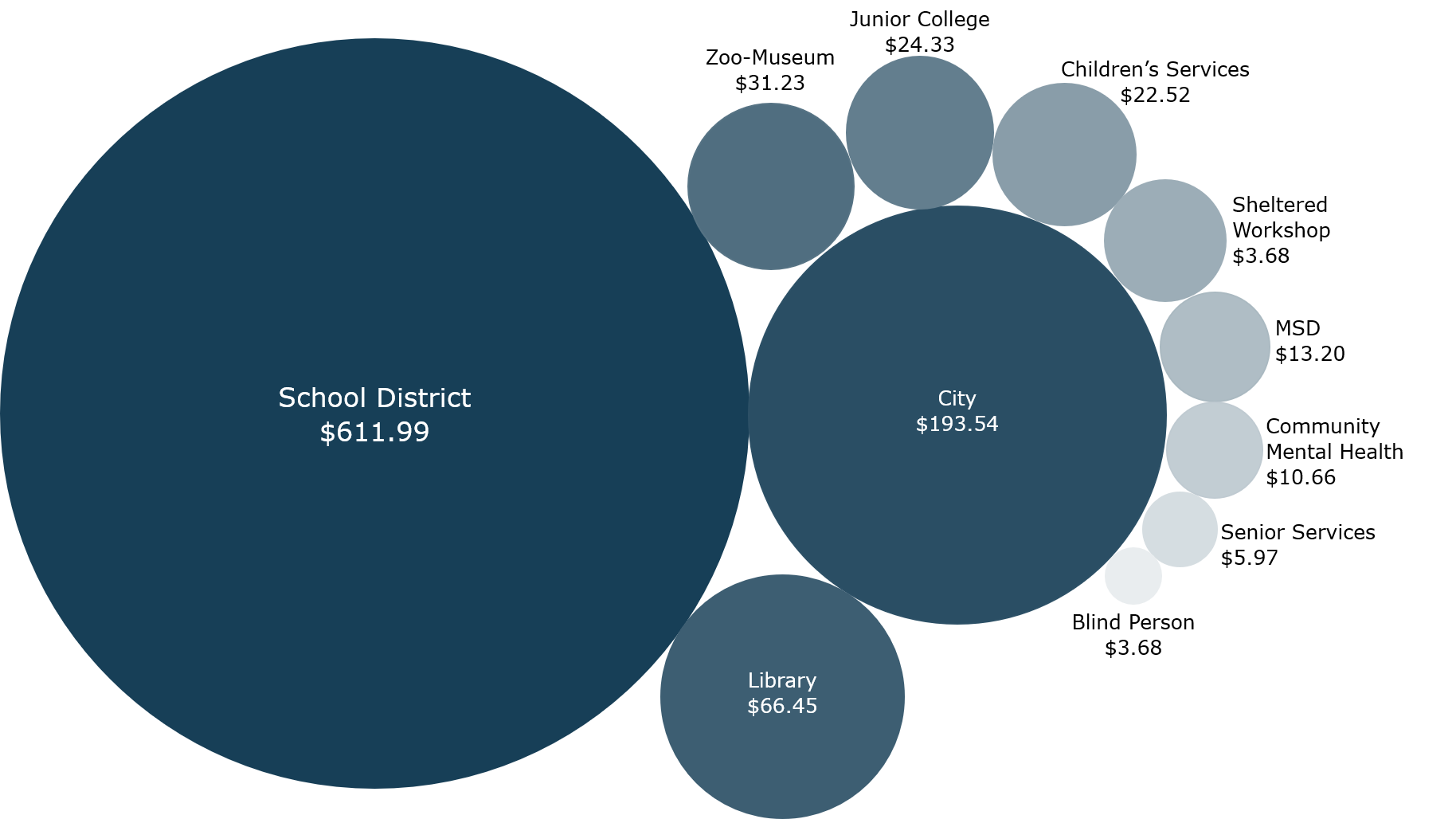

Missouri has a 4225 sales tax and St Louis County collects an additional 2263 so the minimum sales tax rate in St Louis County is 6488 not including any city or special district taxes. Public Safety Sales Tax Quarterly Report 2020 Quarter 4 Beginning Balance 1012020 Restated 19560084. Statewide salesuse tax rates for the period beginning November 2020 102020 - 122020 - PDF.

2020 City of St Louis Merchants and Manufacturers Tax Rate 6262 KB 2020 City of St Louis Special Business District Tax Rates 68983 KB Historical Listing of Property Tax Rates for City of St Louis 7144 KB. For more information please call 314-615-7865. The sales tax jurisdiction name is St.

What Is The. The St Louis County sales tax rate is 0. The St Louis County sales tax rate is.

2020 rates included for use while preparing your income tax deduction. This is the total of state and county sales tax rates. The current total local sales tax rate in Saint Louis MO is 9679.

The combined rate used in this calculator 9238 is the result of the missouri state rate 4225 the 63119s county rate 2263 the saint louis tax rate 15 and in some case special rate 125. The total sales tax rate in any given location can be broken down into state county city and special district rates. Louis county missouri is 2238 per year for a home worth the median value of 179300.

Rate tables and calculator are available free from Avalara. The combined rate used in this calculator 9238 is the result of the missouri state rate 4225 the 63119s county rate 2263 the saint louis tax rate 15 and. Sales Dates for 2022 Sale 208.

Land Tax sales this year are held 5 times a year in April May June July and August. The latest sales tax rate for Saint Louis MO. Special Election In St Louis County.

Louis County Missouri Tax Rates 2020. This is the total of state and county sales tax rates. Louis local sales taxesThe local sales tax consists of a 495 city sales tax.

To further accelerate investment and. The Missouri state sales tax rate is currently. Louis County Missouri Tax Rates 2020.

December 2020 8488. County Tax City Tax Special Tax. The following rates apply to the ST.

Complete Policy Manual of the St. LOUIS COUNTY tax region see note above Month Combined Tax State Tax. Has impacted many state nexus laws and sales.

Land Tax sales are held 5 times in 2022. Life At The Zoo Chester. Louis collects a 4954 local sales tax the maximum local sales tax allowed under Missouri law.

April 19 2022 Published Dates. Louis collects a 4954 local sales tax the maximum local sales tax allowed under Missouri law. This rate includes any state county city and local sales taxes.

CLAYTON St. Sales are held on the 4th floor of the Civil Courts Building at 10 N Tucker Blvd. The December 2020 total local sales tax rate was 7613.

This is the total of state and county sales tax rates. The St Louis County sales tax rate is. Louis which may refer to.

The latest sales tax rate for Saint Louis County MO. St louis county sales tax rate 2020 Saturday May 7 2022 Edit The combined rate used in this calculator 9238 is the result of the missouri state rate 4225 the 63119s county rate 2263 the saint louis tax rate 15 and in some case special rate 125. Real Property Tax Sale St Louis County Website.

The 2018 United States Supreme Court decision in South Dakota v. Free Life Chapel Daycare. Louis County local sales taxesThe local sales tax consists of a 214 county sales tax and a 125 special district sales tax used to fund transportation districts local attractions etc.

The December 2020 total local sales tax rate was. November 2020 8. Louis County Board enacted this tax along with an excise tax of 20 on motor vehicles sold by licensed dealers beginning in April 2015.

Office of the SheriffCollector - Real Estate Tax Department. Louis County Missouri Tax Rates 2020. Has impacted many state nexus laws and sales tax.

CST auctions may extend if a bid is placed within 5 minutes of. The minimum combined 2022 sales tax rate for St Louis County Missouri is. Louis county public safety sales tax quarterly report 2020 quarter 1 beginning balance 01012020 17551454 revenue received 16800556 expenditures family court.

April 5 2022 and April 12 2022. This table shows the total sales tax rates for all cities and towns in St. Louis which may refer to a local government division.

Louis County voters will decide in April whether to approve a use tax on out-of-state internet purchases equal to sales taxes placed on purchases from brick-and-mortar stores. Louis County Division of Performance Management Budget 01082021. May 10 2022 and May 17 2022.

The Minnesota state sales tax rate is currently 688. St Louis County Sales Tax 2021. Louis County Tax Forfeited Land Sale Auctions.

Saint Louis MO Sales Tax Rate. The Missouri state sales tax rate is currently. Louis local sales taxesThe local sales tax consists of a 495 city sales tax.

The sales tax jurisdiction name is St. Louis County Sales Tax is collected by the merchant on all qualifying sales made. The minimum combined 2022 sales tax rate for St Louis County Minnesota is 738.

The 2018 United States Supreme Court decision in South Dakota v. Prop P Quarterly Reportxlsx Author. St louis county sales tax 2021.

The St Louis County sales tax rate is 0. The Collector efficiently manages this complex and overlapping taxing environment by offering a centralized process to expedite the receipt and distribution of over 24 billion annually for personal property taxes real estate property taxes railroad taxes utility taxes merchants taxes and manufacturers taxes. NO LAND TAX SALE MAY 26 2022.

St louis county sales tax 2021.

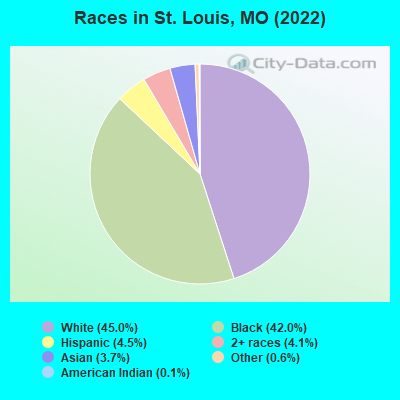

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Collector Of Revenue St Louis County Website

Taxable Sales Down In Many St Louis Areas Show Me Institute

Collector Of Revenue St Louis County Website

Temp Tags New Missouri Vehicle Sales Tax Law Takes Effect In August Fox 2

Online Payments And Forms St Louis County Website

Waiting On Your Tax Bill St Louis County Says Printing Issue Delayed Mailing Vendor Says County Sent Files Late Politics Stltoday Com

Revenue St Louis County Website

St Louis Neighborhoods Guide 2022 Best Places To Live In St Louis

Challengers Emerge For Virginia Commissioner St Louis County Auditor Duluth News Tribune News Weather And Sports From Duluth Minnesota

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Revenue St Louis County Website

Print Tax Receipts St Louis County Website

![]()

Performance Management And Budget St Louis County Website

Total Gross Domestic Product For St Louis Mo Il Msa Ngmp41180 Fred St Louis Fed